Good Planning Requires Nuance

We like simple answers.

“Yes” or “No.”

“Buy” or “Sell.”

“All stocks” or “All cash.”

But real life doesn’t work that way.

Jason Zweig recently asked, “Should you just buy stocks until you die?”

It’s a good question. Especially if you believe, like I do, that owning great companies for a long time has worked really well for patient investors.

Still, my answer isn’t a simple “Yes.”

Because the right answer always depends on your life, your needs, your time frame, your sleep.

Some people can afford to own nothing but stocks. They’ve got steady income and time on their side.

Others need a mix of things—some stocks, some bonds, maybe just enough cash to feel calm when headlines scream.

There’s no perfect formula.

There’s only balance.

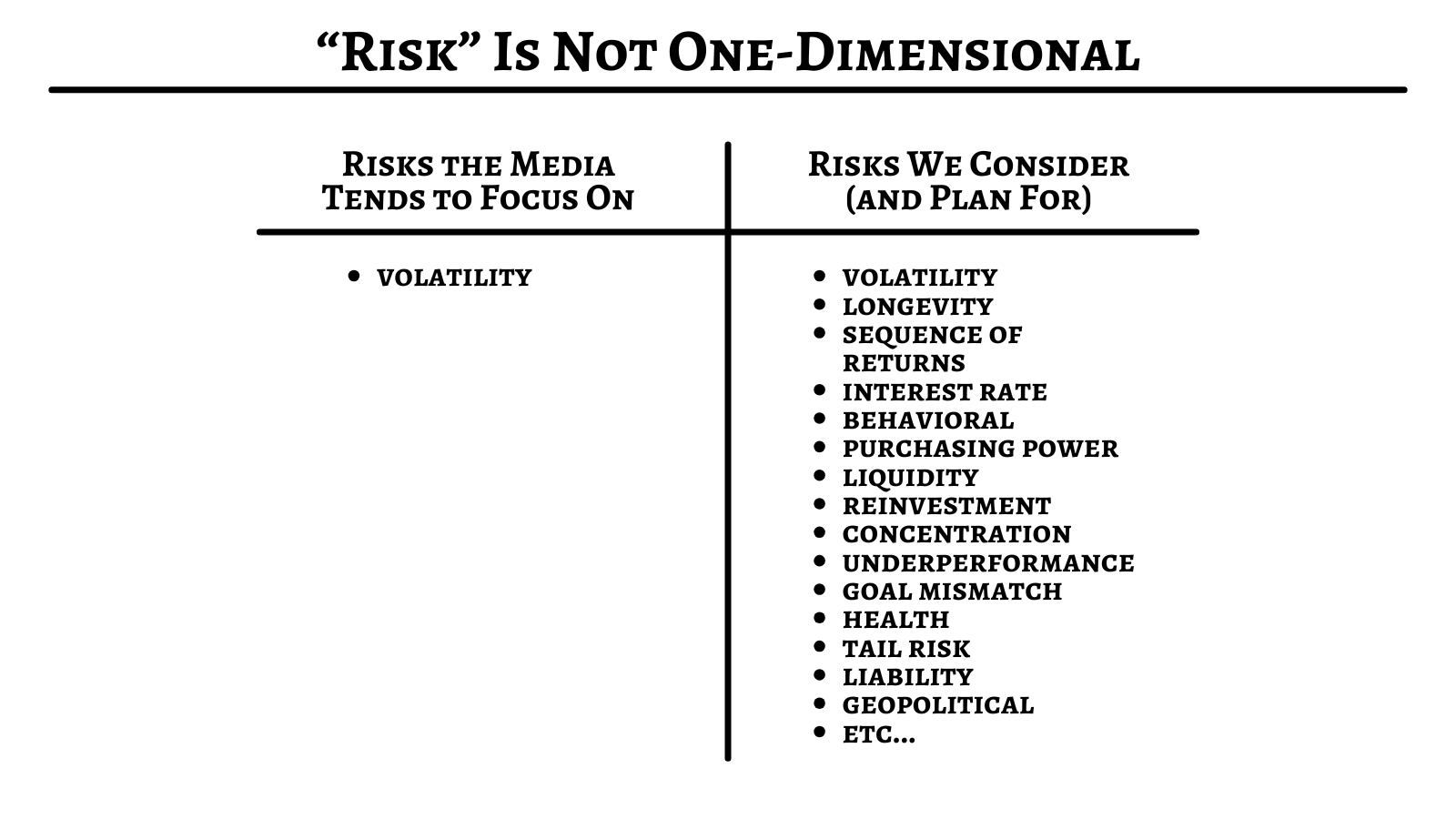

Every choice in your plan carries tradeoffs.

More return, more risk.

More safety, less growth.

More peace of mind, maybe less potential.

The goal isn’t to find the one “right” answer.

It’s to find your right mix.

The one that lets you live your life and still sleep at night.

Because that’s what good planning really is.

Not about being perfect.

About being thoughtful.

About being you.