Give Without Jeopardizing Your Future

Most people I work with want to be generous.

They want to help their kids.

They want to give to causes that matter.

They want to enjoy what they’ve worked for.

But there’s a common hesitation:

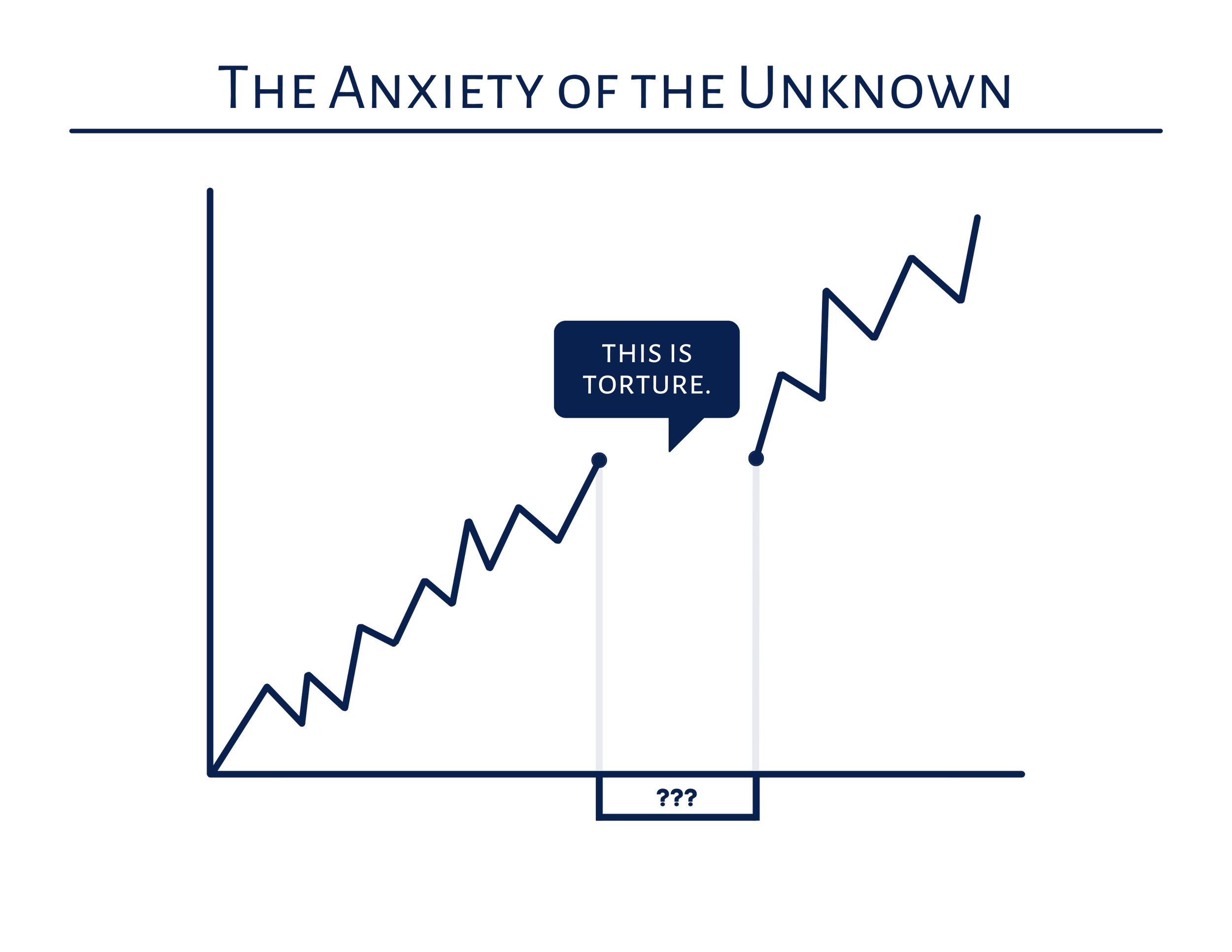

“What if I give too much and run out?”

Good planning answers that question.

Here’s how we do it.

Step 1: We run the numbers for you.

This is where we start.

You tell us what matters.

We do the calculations and show you the results—clear, simple, and easy to understand.

No spreadsheets.

No sales talk.

Just your actual spending capacity.

Behind that snapshot is a calculator built from your income, goals, and lifestyle.

And with two decades of experience in tax prep and investments, we help you see what matters and cut out what doesn’t.

No fluff. Just clarity.

Step 2: You decide how much goes to each bucket.

Once we know the total amount that’s available, you choose where it goes.

Your lifestyle.

Your kids.

Your church or favorite nonprofit.

You don’t have to choose between giving and living. You just need to know the boundaries.

Step 3: We show you where the money should come from, and when.

Now we get specific.

Which accounts are best to use now, and which should wait?

Which assets are better for your kids?

Which are better for charity?

What timing gives you the most tax savings?

We make your giving and spending tax efficient, so your dollars go further—for you and for the people or causes you love.

Bottom Line:

You can be generous, thoughtful, and secure.

You don’t have to guess.

You don’t have to do this alone.

If you’re over 50 and ready to make giving part of your plan, we can walk through it—calmly, clearly, and without pressure.